Ethereum Price Prediction: Will ETH Break Through $3,000 in 2025?

#ETH

- Whale Activity: 1.49M ETH accumulated signals strong institutional interest

- Technical Support: $2,500 level holding despite market turmoil

- Macro Risks: Geopolitical tensions causing short-term price swings

ETH Price Prediction

Ethereum Technical Analysis: Key Indicators to Watch

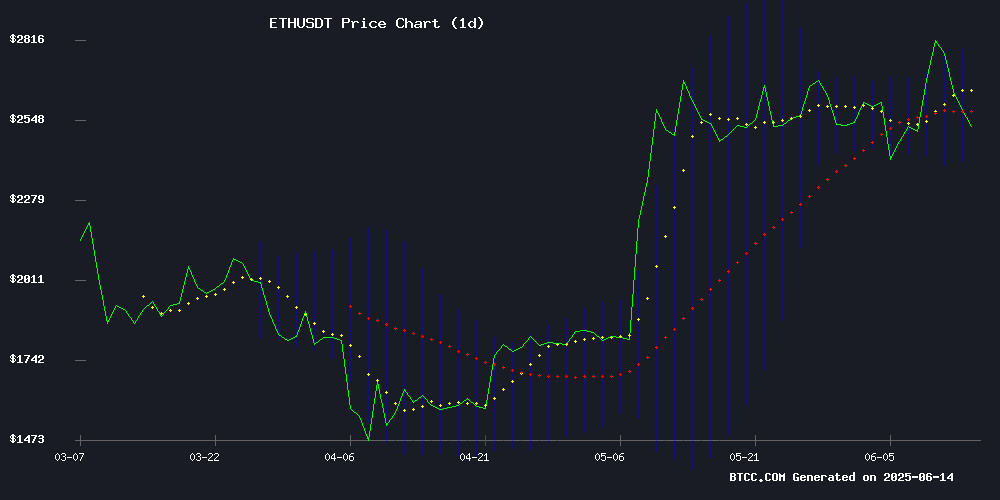

According to BTCC financial analyst William, ethereum (ETH) is currently trading at $2,506.81, below its 20-day moving average (MA) of $2,593.30, indicating potential short-term bearish pressure. The MACD (12,26,9) shows a positive histogram at 5.4945, suggesting some bullish momentum remains. Bollinger Bands reveal ETH is trading near the middle band ($2,593.30), with upper and lower bands at $2,784.55 and $2,402.04, respectively. William notes that a break above the 20-day MA could signal a bullish reversal, while failure to hold $2,500 may lead to further downside.

Ethereum Market Sentiment: Whales Accumulate Amid Volatility

BTCC financial analyst William highlights mixed market sentiment for Ethereum. On one hand, large holders ("whales") have accumulated 1.49M ETH, and the Ethereum Foundation''s $500K legal donation shows strong institutional support. However, geopolitical tensions and a 10-15% price drop due to the Israel-Iran conflict have created short-term uncertainty. William believes the $2,500 support level holding, combined with growing Web3 partnerships (like DRX Token x Bitget), suggests underlying strength despite recent volatility.

Factors Influencing ETH’s Price

Ethereum Whales Accumulate 1.49M ETH as Retail Participation Declines

Ethereum''s largest holders have added 1.49 million ETH to their wallets over the past month, increasing their control to nearly 27% of circulating supply. This strategic accumulation comes amid a 3.72% expansion in whale holdings, signaling growing conviction despite cautious market sentiment.

Retail activity tells a different story. New ethereum addresses plummeted 26.5% while active addresses crashed 55.37% in the past week. The disappearance of transactions above $10 million contrasts sharply with a 106% surge in smaller transfers between $10-$100, revealing speculative rather than committed participation.

The divergence between institutional accumulation and retail hesitation creates a potential inflection point. Should smaller investors follow whales'' lead, Ethereum''s current stabilization could evolve into sustained momentum.

Ethereum Foundation Backs Tornado Cash Co-Founder with $500K Legal Donation

The Ethereum Foundation has pledged $500,000 to support the legal defense of Tornado Cash co-founder Roman Storm, who faces charges including money laundering conspiracy and sanctions violations. The trial begins July 14 in New York, with Storm potentially facing a 45-year sentence if convicted.

Privacy advocates within the crypto community are rallying behind Storm, with the Ethereum Foundation matching community donations up to $750,000. The case has become a flashpoint for debates about financial privacy and open-source development, encapsulated in the Foundation''s statement: ''Privacy is normal, and writing code is not a crime.''

DRX Token Partners with Bitget to Enhance Web3 Sports Fan Engagement

Bitget, a leading cryptocurrency exchange built on Ethereum, has forged a strategic alliance with DRX Token Global to integrate Web3 technology into sports fan engagement. The partnership focuses on leveraging DRX''s Near Field Communication (NFC) chips embedded in sports apparel, enabling fans to interact with physical merchandise via the DRX mobile app.

DRX Token, a Web3-powered crypto asset, aims to revolutionize sports engagement in Asia by bridging blockchain technology with fan communities. The collaboration with Bitget will enhance DRX''s ecosystem through Ethereum''s infrastructure, supporting gamification and community growth.

Ethereum Records First Net Outflow in Over a Month, Signaling Shift in Market Sentiment

Ethereum''s net FLOW data turned negative on June 13, 2025, marking its first outflow in more than 30 days. The platform registered a net withdrawal of $2.1 million, ending a sustained period of accumulation. This reversal contrasts sharply with the bullish momentum seen earlier in June, when inflows peaked at 240.3 units on June 11.

The sudden shift suggests traders may be repositioning or taking profits after weeks of consistent demand. Early June had already shown signs of volatility, with back-to-back outflows on June 4 and 5. Market participants will watch closely to determine whether this represents a temporary pause or the start of a broader trend.

Tornado Cash Founder Fights DOJ Crackdown in Pivotal DeFi Legal Battle

Tornado Cash founder Roman Storm is rallying crypto industry support ahead of his September trial, framing the U.S. Department of Justice''s case as an existential threat to decentralized finance. The DOJ has blocked five of Storm''s six proposed expert witnesses, including blockchain specialist Matthew Edman, in what the developer characterizes as a systematic effort to ''crush'' his defense.

''SDNY is trying to crush me, blocking every expert witness,'' Storm wrote on X. The 2023 sanctions against Tornado Cash—alleging facilitation of North Korean hacker transactions—have escalated into a high-stakes courtroom showdown that could set precedents for non-custodial crypto tools. ''If I lose, it might signal the death of DeFi,'' Storm warned, positioning the case as a referendum on financial freedom versus regulatory control.

The trial''s outcome could ripple across Ethereum''s ecosystem, where privacy tools like Tornado Cash operate as Immutable smart contracts. Prosecutors argue Storm should have implemented know-your-customer controls on the protocol—a demand that contradicts DeFi''s foundational principles of permissionless access.

Ethereum Holds $2,500 Support Amid Geopolitical Tensions

Ethereum remains resilient above the $2,500 support level despite escalating tensions in the Middle East following renewed conflict between Israel and Iran. The cryptocurrency has weathered a 14% drop since Wednesday, with bulls defending the critical zone that historically precedes rallies toward $4,000.

Analyst Rekt Capital notes this level previously catalyzed major moves in August 2021 and early 2024. Market sentiment hangs in equilibrium—geopolitical risks fuel volatility while technicals suggest latent upside potential. A decisive hold here could reignite altcoin momentum across exchanges.

The current consolidation represents a stress test for ETH''s market structure. Either history repeats with another parabolic advance, or macro headwinds trigger deeper corrections. Traders await the next directional cue as liquidity pools tighten around this pivotal threshold.

Crypto Market Recap: Geopolitical Shocks and ETH Potential Highlight Binance Research Report

Binance Research''s latest report reveals a turbulent week for global markets, with cryptocurrencies caught between geopolitical tensions and promising developments for Ethereum. The broader crypto market initially rebounded on improved US-China trade relations and a potential truce between Donald Trump and Elon Musk, only to face renewed volatility from Middle East conflicts.

Ether (ETH) emerged as a standout performer, with analysts noting growing institutional interest and fundamental improvements. The asset''s positive trajectory contrasted with broader market swings triggered by safe-haven flows into Gold and oil. Binance''s data showed cross-asset correlations breaking down as digital assets reacted sharply to geopolitical headlines.

SharpLink Acquires $462M in Ethereum Amid Market Downturn, Becoming Largest Public ETH Holder

Sports betting company SharpLink has made a bold MOVE in the cryptocurrency market, purchasing 176,271 Ethereum (ETH) worth approximately $462.95 million during the recent price decline. The transaction, executed around June 13 at an average price of $2,626 per ETH, positions SharpLink as the largest publicly traded holder of Ethereum globally.

The firm plans to use Ethereum as its primary treasury reserve asset, citing ETH''s programmability, yield potential, and alignment with long-term financial strategies. Despite the significant investment, Ethereum''s price has continued to slide, currently trading at $2,513—leaving SharpLink with a paper loss of about $20 million. Over 95% of the acquired ETH has already been staked or placed into liquid staking protocols, contributing to network security.

This acquisition highlights growing institutional confidence in Ethereum''s long-term value proposition, even as short-term market conditions remain challenging. The move has reignited discussions about Ethereum''s role in corporate treasury strategies and Web3 infrastructure development.

Robinhood Wallet Moves $203M in Ethereum in Four Large Transfers

Robinhood-linked accounts executed four sequential transfers totaling 80,000 ETH ($203 million) to unknown wallets earlier today. Blockchain tracker Whale Alert flagged each transaction, with each batch moving exactly 20,000 ETH—valued at approximately $50.9 million per transfer at current prices.

The motive remains speculative, but the patterned movement suggests institutional preparation rather than retail activity. Potential explanations include liquidity provisioning for DeFi pools, staking program initialization, or collateral positioning for lending services. The equal partitioning may indicate gas fee optimization strategies.

At Ethereum''s current $2,536 price point, these transfers represent a material portion of Robinhood''s ETH holdings. Such concentrated movements by a single entity often precede significant market activity, though no definitive catalyst has been identified.

Ethereum Crashes 10% as Israel-Iran Conflict Sparks Market Turmoil

Ether plunged more than 10% in 24 hours as geopolitical tensions between Israel and Iran rattled global markets. The sell-off triggered a surge in bearish bets, with ETH''s long/short ratio dropping to 0.86—indicating dominant short positioning across derivatives markets.

On-chain metrics confirm the pessimistic outlook. ETH''s Balance of Power indicator registered -0.69, reflecting intense selling pressure. The altcoin''s decline mirrors broader risk-off sentiment as traditional and crypto markets react to escalating Middle East conflicts.

Traders are pricing in further downside, with futures data showing accelerated short accumulation since Friday''s airstrikes. Market participants appear to be hedging against prolonged volatility as the conflict shows no immediate signs of de-escalation.

Ethereum’s Sharp 15% Fall: A Bull Trap Resets Overextended Leverage

Ethereum plunged nearly 15% from its weekly high of $2,878, caught in a classic bull trap as overleveraged positions unwound. The downturn follows a surge in open interest to record levels, signaling overheated speculation.

Binance’s ETH futures open interest alone spiked 38% in five days, reaching $6.9 billion—the second-highest level this year. Such extreme leverage often precedes violent corrections when support breaks.

Smart money now watches critical support zones. A hold could signal accumulation; failure may trigger deeper liquidations. The market’s deleveraging phase underscores crypto’s volatility—where risk and opportunity collide.

How High Will ETH Price Go?

William from BTCC projects Ethereum could rally to $2,800-$3,000 if it sustains above the 20-day MA ($2,593), citing whale accumulation and institutional support. Key resistance levels are outlined below:

| Level | Price (USD) | Significance |

|---|---|---|

| Resistance 1 | 2,784.55 | Upper Bollinger Band |

| Resistance 2 | 3,000.00 | Psychological Round Number |

| Support 1 | 2,500.00 | Current Holding Level |

| Support 2 | 2,402.04 | Lower Bollinger Band |

Short-term volatility from geopolitical events may persist, but the long-term outlook remains bullish if ETH maintains $2,500 support.